Puoi leggere questo articolo anche in italiano

We covered the relevance of Bitcoin in our last article "Why is Bitcoin important?" It focused on several key attributes: Bitcoin is scarce (making it “hard money” that nobody can create out of thin air), it provides the freedom to transact internationally, and you alone decide what to use it for.

Is this always the case? Unfortunately not, as a lot of bitcoin are held on exchanges or custodial wallets managed by financial institutions.

Why is it a bad idea to keep your bitcoin on an exchange? Why should you go through all the trouble and hold the coins yourself?

Let us explain why it is so important to have your own wallet.

Bitcoin is digital cash

The true innovation of Bitcoin is not only that it is a scarce digital asset but also a bearer asset: You can hold it yourself without trusting a third party. This means that you don’t need to rely on a company or another person. In a digital world that is increasingly centralizing and forces users to rely on ever fewer companies, this makes Bitcoin unique. It is made to work without banks and custodians. It gives control back to the user.

Taking control of your own coins is crucial in order to ensure the core properties of Bitcoin stay intact. To achieve this, the open permissionless monetary system needs to be protected by its own users.

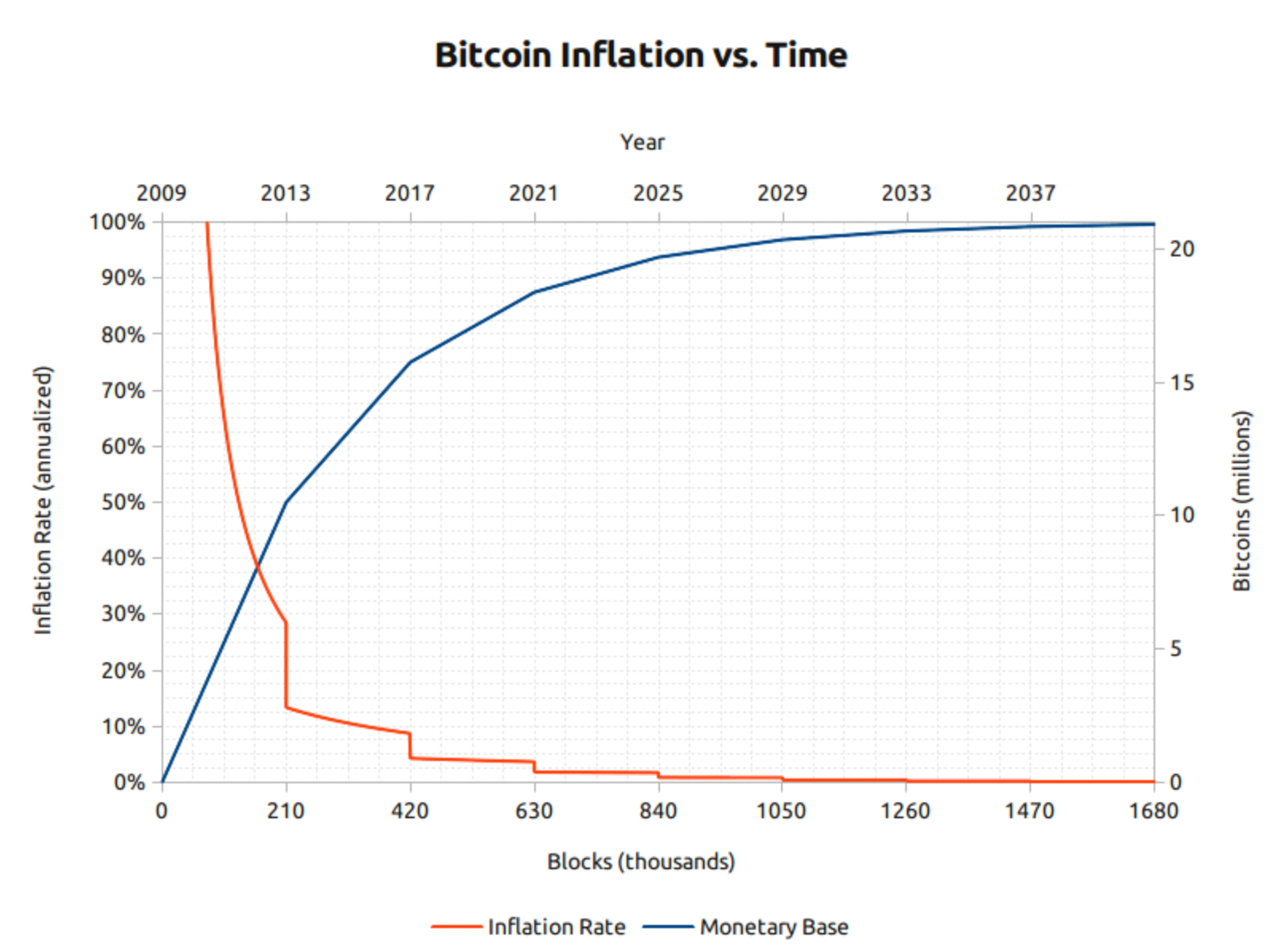

21 million, and not a satoshi more

Do you remember the “Money printer go brrr” meme from our last article? A lot of coins are held on exchanges. This is likely because exchanges are the first way most people interact with Bitcoin. But they actually discourage users from withdrawing their coins by artificially making it more expensive to send coins to your own wallet. They do this because it increases the likelihood that users trade their coins and pay fees. The other reason why exchanges don’t want you to withdraw your coins is that this way, they can lend out your coins to traders.

The coins that are shown in your exchange account aren’t actual Bitcoins, but what’s called an “IOU” (“I owe you”). In essence, it’s a promise that they will pay you a certain amount in case you want to have it. This, in theory, enables the exchange to create an infinite amount of synthetic Bitcoins. Does the exchange actually own the Bitcoins that are reflected in the account balances of the exchange? Are they lent out to other parties? Without proper proof-of-reserves, there is no way to know.

Only 21 million Bitcoins will ever be created, and the only way to make sure there isn’t more in circulation is to hold them yourself.

No need to ask anyone

Owning your money should also mean that you do with it whatever you want. As we mentioned in our last article, every intermediary that is required in order to spend your bitcoin can simply refuse to execute your payment.

Holding your coins on an exchange means that you will have to ask for permission to spend them. While most exchanges might not have bad intentions, the local laws might not allow them to send you your own money. We are already seeing law proposals that limit the ability of exchanges to pay out customer funds.

Voyagers, today we made the difficult decision to temporarily suspend trading, deposits, withdrawals, and loyalty rewards. Read more at: https://t.co/bpGFqQtjAs

— Stephen Ehrlich (@Ehrls15) July 1, 2022

This goes directly against Bitcoin's idea of having a permissionless financial system that enables anyone to participate, independent of their gender, country, ethnicity or political views. To make use of this, it needs to be used peer-to-peer, without middlemen.

With your own wallet, you don’t need to ask permission to create a bitcoin address or to send a transaction. That way, nobody can stop you from sending money to anyone.

Exchanges get hacked all the time

While exchanges might have a bigger budget to spend on their security, they face inherent challenges in securing your Bitcoin. On the one hand, they need to keep it accessible enough so you can automatically withdraw them. At the same time, they need to be protected from hackers.

Because exchanges hold a lot of bitcoin for their customers, they have become enormous targets for hackers. Time has shown that exchanges, no matter their size and popularity, have become victims of hacking attacks and lost customer funds. For smaller losses, exchanges might be able to pay back the customers, but a more significant hack can easily lead to the insolvency of the exchange. In this case, the exchange might not be able to pay you back.

Not only is a private person a much smaller and therefore more unlikely target, but they can also make use of safer custody practices that an exchange can’t.

Don’t share all your private information

By giving up the custody of your Bitcoin, you are also giving up your privacy. Anytime you want to spend your coins, you will have to tell the custodian where you want to send these coins. That means your entire bitcoin transaction history will be held by a company that will have to comply with the law. Depending on where you live, this might be a big issue.

It also means that the exchange always knows exactly how much money you own. That’s why having your own wallet is essential to use Bitcoin privately.

Conclusion

In order to ensure the properties of Bitcoin remain intact, it is necessary to hold it yourself. Having a big part of the supply locked up on exchanges will eventually lead to the degradation of its core values.

Nowadays, it’s easy to secure and use Bitcoin without a custodian. Everyone can easily take possession of their own coins. The best and most secure way to do so is by using an open-source hardware wallet.

Why should I store Bitcoin myself?

In order to make use of the various unique properties of Bitcoin, you need to be in control of your Bitcoin. This is not the case if they are held on an exchange account. Holding Bitcoin on an exchange poses many risks, such as hacks, exit scams and phishing.

What should I use to store my Bitcoin?

Storing Bitcoin yourself can be intimidating. Luckily, there's hardware wallets, like the BitBox02, that make it extremely easy to save your Bitcoin. They equip you with everything you need to securely stay in control of your coins without worrying about getting hacked.

Is self custody dangerous?

Self custody means that you yourself are responsible for the security of your coins. By using the appropriate tools, such as a hardware wallet, it becomes trivial to ensure the safety of your Bitcoin.

Don’t own a BitBox yet?

Keeping your crypto secure doesn't have to be hard. The BitBox02 hardware wallet stores the private keys for your cryptocurrencies offline. So you can manage your coins safely.

The BitBox02 also comes in Bitcoin-only version, featuring a radically focused firmware: less code means less attack surface, which further improves your security when only storing Bitcoin.

Shift Crypto is a privately-held company based in Zurich, Switzerland. Our team of Bitcoin contributors, crypto experts, and security engineers builds products that enable customers to enjoy a stress-free journey from novice to mastery level of cryptocurrency management. The BitBox02, our second generation hardware wallet, lets users store, protect, and transact Bitcoin and other cryptocurrencies with ease - along with its software companion, the BitBoxApp.