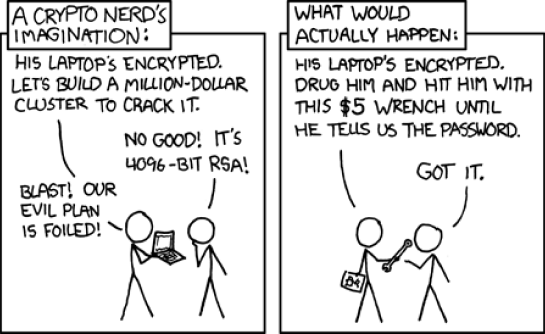

Extortion protection

Safeguard your investments against the unforeseen with coverage against burglary, robbery and extortion threats, also known as a “$5 wrench attack”.

Have peace of mind that you if push comes to shove, you can part with your precious bitcoin without endangering yourself, knowing it’s not the end of the world because Bitsurance got you covered.

Original artwork by XKCD licensed under Creative Commons 2.5.